The Gregory School Annual Fund and the Arizona State Tax Credit are both vital financial pieces of a TGS education and both rely on family participation.

But how are they different? And what do they do, exactly?

Read on!

All About The Arizona State Tax Credit

The Arizona State Tuition Tax Credit allows people who pay Arizona state taxes to direct a portion of their tax obligation (either what has already come out of their paycheck or what they owe) to help provide need-based tuition assistance for Gregory School students.

NOTHING! When you take the credit, you are simply asking the state of Arizona to divert a portion of your Arizona tax obligation (either what has already come out of your paycheck or what you owe). Your refund will either be bigger or you will owe less, by the exact amount that you contributed to the tax credit program. (Maximum contribution amounts apply.)

The Arizona State Tuition Tax Credit enables students who could not otherwise afford a Gregory School education to be here, enriching the lives of these students, their families, and our entire campus community. The tax credit changes all of our lives!

Call or go online to one of our partner School Tuition Organizations (STOs) and make your contribution. When you do your taxes, the state will give you a dollar-for-dollar credit (either a bigger refund or you'll owe less) by the amount you contributed. Two STOs that we partner with are AISSF and Institute for Better Education.

For tax year 2024, you can give up to your tax obligation or $1,459 for single filers/$2,910 for married filing jointly, whichever is less. We recommend consulting a tax professional when participating in the tax credit.

If you work in Arizona or have any Arizona tax obligation, the answer is YES! And we hope you will do so. This is a wonderful way to contribute to the community and help other students in the same way that your student is being helped.

All about The Gregory School Annual Fund

The Gregory School Annual Fund is an account that anyone can donate to to help support the school financially. It is a line item in our operating budget, along with tuition, grants, interest income, facilities rentals, and MindsAlive! Summer Camp. Nearly every independent school in the United States asks families, alumni, faculty, staff and the Board of Trustees to make a donation to their annual fund.

Because tuition does not cover the full cost of educating a student. At The Gregory School, for every dollar that it costs to educate a student, tuition covers 71 cents. The annual fund helps make up the difference of all the 29-cent deficits for every student, every day.

If tuition covered the difference, it would be prohibitively high. We don’t want to ask our families to take up the entire deficit. Instead we ask families to contribute what is comfortable and meaningful to them, by way of the Annual Fund, to help bridge the gap.

We ask families to give at an amount that is comfortable and meaningful to them. There is no set amount expected.

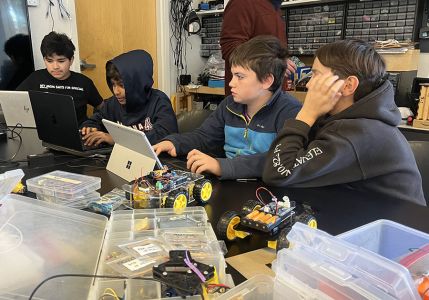

You do! Every day when your student enters the lighted, climate-controlled classroom, interacts with a teacher, goes on a field trip, has a guest speaker, participates on a team, creates something in the FabLab, uses an art supply, or selects a book from the library, you are seeing your Annual Fund donation in action.

You could, but we wish you wouldn’t. A $20 donation can cover paint for an art class. A $100 donation supports a guest speaker. $500 would pay the referees for flag football home games for an entire season. We’re all in this together, and it all adds up.

Because The Gregory School is a 501(C)3 nonprofit, donations to the Annual Fund are tax deductible. This means that you may be able to subtract the amount of your donation from your earnings when you do your taxes, lowering your taxable earnings.

Tax Credit does not mean Tax Deductible. When you participate in the Arizona State Tuition Tax Credit, you are not making a gift; you are simply directing your Arizona tax obligation to help a TGS student pay tuition.

You can make your donation in the following ways:

- Online at gregoryschool.org/support

- By check or cash in Zeskind Hall

- By mailing a check to The Gregory School, Attn: Annual Fund, 3231 N. Craycroft Rd. Tucson, AZ 85712